If you're a first time entrepreneur incorporated in Delaware and you've authorized the standard 10,000,000 shares, you'll probably freak out when you receive your first Delaware franchise tax bill for approximately $70,000.

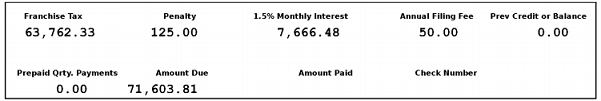

I received a franchise tax bill for $71k.

I received a franchise tax bill for $71k.

Don't freak out! You can pay just $400 instead of $70k. Here's why. In the state of Delaware tax can be calculated using two methods:

- The Authorized Shares Method (default method used to issue the tax bill)

- The Assumed Par Value Capital Method

You can calculate and pay tax using one of these methods. One of them will produce a smaller tax bill depending on the structure of your corporation.

Just call your Delaware registered agent and they'll take care of this.

Your registered agent will use the assumed par value capital method to recalculate the tax and you'll pay $400.

Your registered agent will use the assumed par value capital method to recalculate the tax and you'll pay $400.

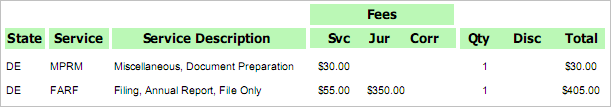

And that's what I did. I paid $400 in Delaware state taxes using par value capital method instead of $70,000 that was on the bill.

Here's a brief overview of both methods.

The Authorized Shares Method

Using the authorized shares method you pay $75 for every 10,000 authorized company shares. Here's how you approximately calculate the franchise tax using this method:

total number of authorized shares / 10,000 * $75

If you've 10,000,000 authorized shares, you'll get hit with a $75,000 tax. This is the default method that is used to calculate the franchise tax in Delaware. This is the tax bill you'll get. Don't pay this. Instead use the assumed par capital method.

The Assumed Par Value Capital Method

The assumed par value capital method uses a completely different way to calculate tax that involves total gross assets, issued and authorized shares, and the par value per share. This method is much more complicated but it produces $400 in the end. :)

It's quite impossible to explain the steps you need to take to calculate the tax using this method in a blog post. Please see examples, calculator and more information see How To Calculate Franchise Taxes on the State of Delaware website. Or better yet just call your registered agent and they'll calculate and pay this on your behalf.

Until next time!